How To Finance Your Boom Lift The Correct Way

Equipment Financing

You can cooperate with a financier or lender that specializes in financing equipment. They will give you money to buy the boom lift, and over a predetermined time period, you will pay back the loan amount plus interest. Collateral for the loan is the boom lift itself.

Rent or Lease

You have the option of choosing a lease or rental agreement rather to making an outright boom lift purchase. While making regular payments, leasing enables you to utilize the boom lift for a predetermined time. A charge is paid for a specific period of time under a rental agreement, which is shorter-term. If you have a temporary need for a boom lift, leasing or renting one may be flexible.

Financing from the Manufacturer or Dealer

Many boom lift manufacturers or dealers provide consumers with financing alternatives. They might offer internal funding initiatives or have relationships with financial institutions. Investigate these choices to discover whether they provide enticing terms or special offers that meet your needs.

Business Line of Credit

If your company is well-established, and you have a solid credit history, you might want to think about requesting a business line of credit. This enables you to borrow money as needed and pay it back gradually. It gives you freedom when buying equipment like a boom lift and managing your cash flow.

Equipment Leasing Firms

There are specialized equipment leasing firms that concentrate on financing particular classes of equipment, such as boom lifts. These businesses are aware of the market value of the equipment and may design leasing arrangements to meet your requirements.

SBA Loans

Government-backed loans from the Small Business Administration (SBA) are available for a variety of commercial uses, including the financing of equipment. SBA loans are a popular choice for qualified firms since they often have lower interest rates and longer repayment schedules.

Side Note: Boom lift prices vary according to the size and kind of machinery. A small boom lift with a height of 30 feet can cost as little as $10,000, but a large boom lift with a height of 60 feet can cost as much as $50,000. A brand-new boom lift costs, on average, $25,000 to purchase. Depending on the equipment's age and condition, the price of a secondhand boom lift can range from $15,000 to $20,000. In 2023, aerial lifts can be purchased for as little as $6,300 and as much as $83,000, with day rates ranging from $330 to $2,000. Aerial lifts can also be rented for $650 to $4,900 per week.

With these tips, it's important to thoroughly investigate and compare terms, interest rates, repayment schedules, and any related costs before deciding on any financing plan. The best way to finance the purchase of a boom lift depends on your budget, cash flow estimates, and the unique requirements of your company. To make sure your choice is well-informed and in line with your company's objectives, speak with financial consultants or other experts.

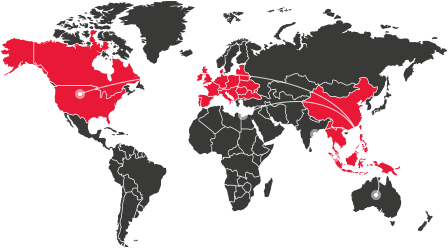

You might need the right pairs of shoes to complete your aerial lift purchase. APEXWAY got you! We offer solid tires of various sizes for your boom lift machinery.

Click on the links below for more information about boom lifts solid tires: